The Rise of AI in Real Estate: How GRID Powers Smarter, Faster Investments

Last Updated: December 22, 2025

Get on the grid - it starts with a demo.

A changing landscape

The real estate industry is entering a new era. The global property-technology (“PropTech”) market is projected to grow from USD 36.08 billion in 2024 to USD 41.52 billion in 2025, at a compound annual growth rate (CAGR) around 14.4 %.This growth is driven in large part by the adoption of artificial intelligence (AI) and machine learning.

In the Philippines the real estate sector has long dealt with challenges such as fragmented data, manual processes and limited transparency. For buyers, sellers, brokers and investors these challenges cost time and money.

Into this environment, GRID enters with a mission: to apply AI and digital tools to make investment decisions smarter, faster and more reliable.

Why AI matters in real estate

Here are four reasons AI is becoming vital to property investment:

- Speed: AI can sift through large volumes of listing data, market trends and transaction records in seconds. This enables faster decision-making on properties.

- Precision: Machine learning models can detect patterns and signals invisible to manual review. That means smarter price setting, risk assessment and opportunity spotting.

- Transparency: When data is aggregated and analyzed, stakeholders can see more of the picture. Buyers trust that they are comparing apples to apples.

- Scale: For investors managing multiple properties, AI offers consistent analysis across geographies, property types and time.

For example, AI-driven valuation models can estimate likely resale value or rental yield more accurately than legacy spreadsheets. And matching algorithms can propose investment opportunities fitting a user’s specific criteria. These tools reduce guess-work and help investors act with confidence.

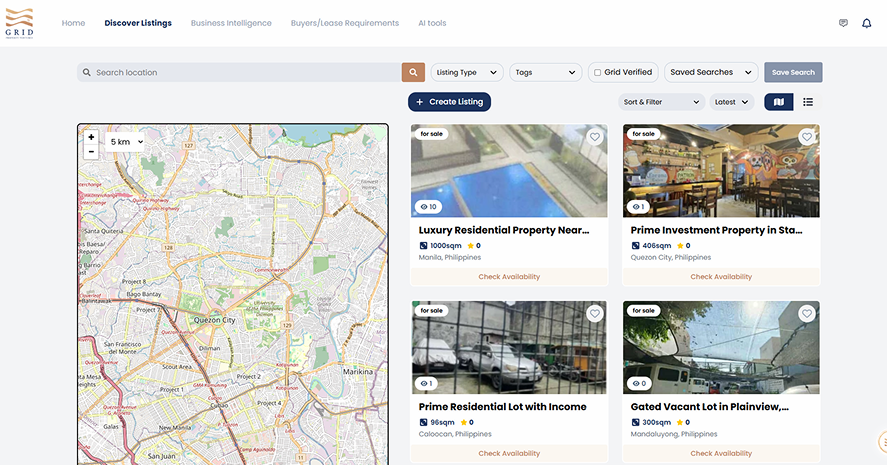

GRID’s technology approach

GRID was founded in 2018 by CEO Zaira Tumang and her team, with the goal of transforming how real estate runs in the Philippines and beyond. The company combines local property-market experience with digital tools to deliver better outcomes for all stakeholders.

Some of the core features include:

- Verified listings and detailed property data, so users rely less on incomplete information.

- A platform that connects property owners, brokers, investors and developers via one interface.

- AI-driven matching of buyers and listings, based on precise user criteria and market signals.

- These capabilities mean that investment decisions can be grounded in fact rather than intuition alone.

How investors benefit

If you are an investor — whether you are acquiring your first unit or managing a portfolio — GRID offers clear advantages:

- Data-backed opportunity identification: Instead of scanning dozens of listings manually, you can use GRID’s analytics to highlight properties that meet your criteria (location, size, yield, condition).

- Faster deal flow: With matching algorithms working behind the scenes you see relevant opportunities sooner. That means you act before others.

- Reduced risk: Better information means you identify red flags (title issues, unrealistic pricing, poor tenancy forecasts) earlier. GRID’s model was built to tackle legacy problems in Philippine real estate.

- Clearer exit planning: AI models can help estimate not just purchase price but likely resale value or rental performance over time.

For example, suppose you are targeting commercial property in Metro Manila with a rental yield above 6 % and a holding period of five years. GRID’s platform can help surface listings that meet those thresholds and show likely hold-period outcomes based on historical data.

How sellers and developers gain too

GRID does not only serve buyers and investors. If you are a property owner or a developer you also benefit:

- You can list your asset with verified data, ensuring better visibility and more qualified leads.

- The platform helps you set realistic pricing by referencing local comparables and market trends derived via AI.

- You reach a broader network of serious investors who use GRID’s matching tools and analytics, increasing your chances of quicker exits or leases.

In short, the AI tools serve both sides of the transaction and make the process more efficient overall.

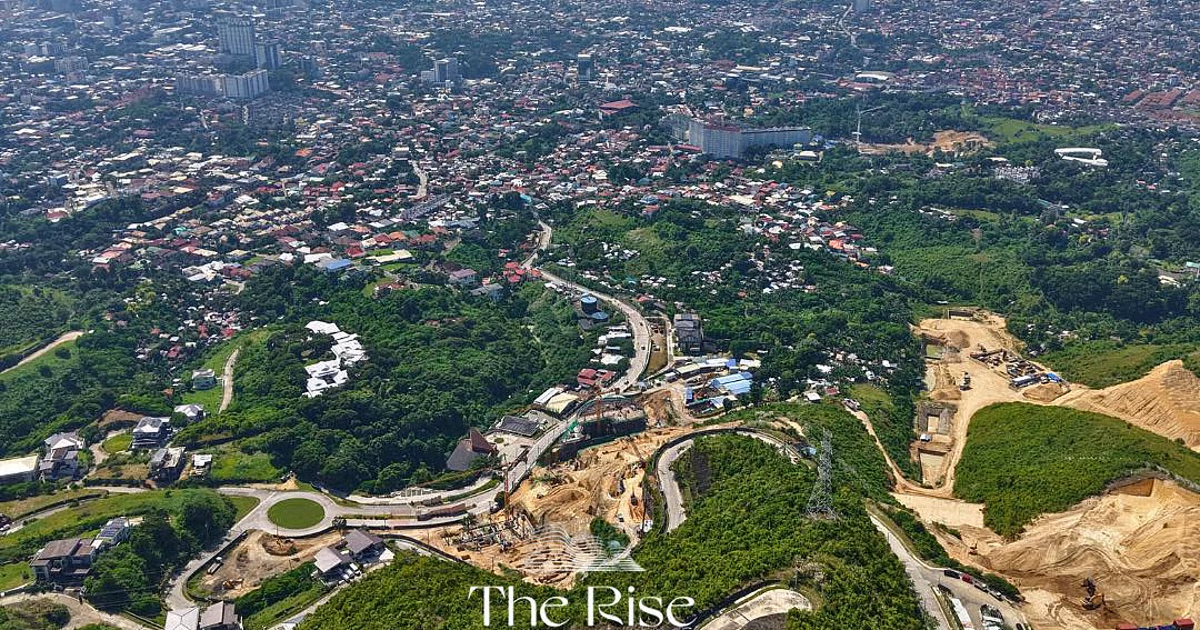

Real-world context: Philippine property market

In the Philippine context the need for better tools is urgent. The United Nations Human Settlements Programme (UN-Habitat) reported a housing backlog of 6.5 million units in 2022 with risks of it growing to 22 million by 2040 if unaddressed. That backlog underscores structural weaknesses in the market.

Meanwhile, the traditional process of listing, matching, negotiating and closing remains fragmented. Many brokers operate independently, data is inconsistent and manual processes dominate. GRID addresses that gap by offering a unified platform and intelligent tools.

In Asia-Pacific the PropTech market is expected to grow at the fastest rate globally. For the Philippines this offers an opening to leap-frog old methods and adopt smarter workflows.

Smart investment in practice

Here is how the process unfolds for an investor using the GRID platform:

1. You create an investor profile with your target asset type, budget, location preferences and hold strategy.

2. GRID’s AI matches you with live listings that meet your criteria, ranking them by expected return, risk and liquidity.

3. You review the detailed data package for each listing: verified title status, occupancy history, neighborhood trends, yield forecast.

4. You compare shortlisted options side-by-side with help from GRID’s dashboard.

5. You engage your broker or GRID’s recommended service provider to conduct due diligence, valuations and legal checks.

6. You execute the transaction more quickly because you already arrived informed and ready.

7. Over the hold period you monitor performance through GRID’s analytics module, and when you are ready to exit you use the same platform to list or match your asset.

This workflow compresses what used to take weeks or months into days or even hours.

Why trust matters in AI-enabled real estate

Adoption of AI in real estate comes with a responsibility. Algorithms work well only when built on clean, accurate data. GRID emphasises verification of listings and consistent processes.

When you rely on an AI system you still need transparency in how the outputs are derived, and a human-centred service layer that handles nuance. GRID’s leadership emphasises the human side: founder Zaira Tumang says the business began with her experience on the ground in Makati and the realisation that relationships, trust and collaboration matter.

In other words, you get the best of both worlds: data intelligence plus human judgement.

The competitive edge for Philippine market investors

When you compare traditional property-investment methods and the new AI-enabled model via GRID, the differences are clear:

- Traditional: Manual listing reviews, broker-by-broker outreach, reactive decision making, limited market intelligence.

- GRID-powered: Algorithmic matching, rich data dashboards, proactive opportunity alerts, streamlined transaction path.

For you this means you decide faster, act sooner and hold more clarity. That can translate to better yields, less idle time and lower transaction cost.

In a market like the Philippines where local insight matters, GRID’s combination of market domain and digital tools gives you an advantage.

What to look for when evaluating AI platforms

If you evaluate any real-estate platform that claims to use AI, keep these criteria in mind:

- Does the system use verified data, not just user-generated listings?

- Are analytics and models transparent or “black boxes”?

- Is the platform built for your target asset type (residential, commercial, land)?

- Does the system include workflow support beyond matching (due diligence, legal, tax, exit tools)?

- Is there human support when needed? AI can assist but it cannot manage every nuance alone.

GRID meets these criteria by design: verified listings, investor-focused tools, connection among owners, brokers and service providers, and a track record in the Philippine market.

Looking ahead

As AI in real estate continues to evolve you should expect more features: deeper predictive analytics (e.g., micro-neighbourhood vacancy trends), visual-data integration (such as drone imagery or aerial data), and automated workflows for closing and title transfers. The global proptech growth supports this trend.

For you as an investor in the Philippines, this means the window is open. By using GRID now you position yourself ahead of the curve rather than following the competition.

Wrapping It All Up

Investing in real estate has always required three things: good property, fair price and clear exit strategy. With AI-enabled tools through GRID you add a fourth: speed. You access reliable data, you match quickly, you act with precision and you monitor performance intelligently. The traditional delays, manual work and uncertain information become less dominant.

When you partner with a platform built for the local market and modern technology you increase your chances of creating real value. GRID brings you that opportunity. Use it, and you power smarter, faster investments in a market ready for digital transformation.